You should be aware of the following things before making a decision if you are considering a Lending Club mortgage. These are: Review, Repayment, Credit score and Origination fee. Learn more. Lending Club loans are a great choice for those who need a fast, easy loan.

Review

Lending Club was a peer–to-peer loan service that took out the banker. It allowed investors to lend to borrowers and set their interest rates. The company was successful for several reasons: it provides investors with excellent returns while giving borrowers access to fast funds at competitive interest rates. It is important to research any investment opportunity before you invest.

Lending Club's interest rate is determined based on the borrower’s credit quality. The borrower’s debt-to income ratio, credit score and credit activity determine the loan grade. A loan grade that is lower for borrowers with poor credit ratings will result in lower borrowing rates.

Repayment

When you have a LendingClub account, you can start repaying your loan in as little as one month. Your account will automatically be charged with the principal and any interest on your loan when you make a monthly payment. The fees associated with receiving the payments will also be credited to your bank account. You won't be charged any fees for missing payments.

Once the loan has been paid off, you are free to move on with your financial future. You can withdraw the money to pay off any other debt or loans. The money will reach your bank account.

Credit score

Before you apply for a loan, it's important to have a good credit score. Lending Club provides a simple process to obtain a loan. You don't need to be a company member to apply. Lending Club offers borrowers the "Check your Rate" option. This soft pulls credit from borrowers to show them if they qualify for the loan.

Your most recent credit report can help you determine your risk level. Lending Club offers a risk assessment which includes your FICO score. Your score will also be calculated and given a risk grade ranging from A to G5. Lending Club also assigns a numerical ranking for each letter grades. Lending Club will not only assess your risk but also evaluate your credit history and income. A borrower with an income range of $90,000-$100,000 will likely receive the best terms. Even borrowers with lower incomes than the minimum criteria may still be eligible for a favorable rate if they have a cosigner.

Origination fee

LendingClub, one of the most popular P2P lending platforms in America, is LendingClub. It has been in dispute with Federal Trade Commission over charging origination fees for loans. The company will cease offering these services in December 2020 and focus on becoming a full-spectrum bank that offers fintech marketplace banking.

In general, personal loans have an origination charge of between 1% and 6% of their loan amount. Additional fees include late fees and a prepayment penalty. These fees are not mandatory to be paid upfront. Late fees are assessed if payments are received more than 15 business days late.

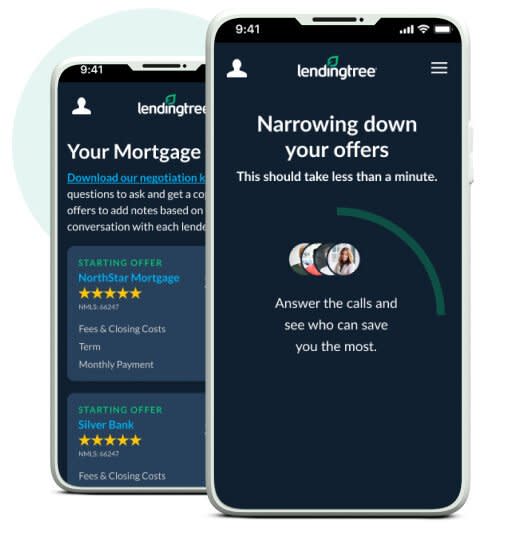

Approval process

Lending club is an on-line peer-to-peer lender that connects borrowers with investors. Lending club offers financial information and loans at lower interest rates than traditional bank branches. Lending club also offers underwriting and loan servicing. Members have the ability to borrow money, or invest in loan portfolios that offer higher interest rates than savings. To become a member, applicants must be at least 18 years old, have a valid bank account and social security number, and be a U.S. citizen. Minimum credit score: 660

LendingClub borrowers need to submit an online application in order to apply for a loan. They should include pay stubs, a photo ID, and recent utility bills and bank statements. Once the application has been submitted, borrowers can expect a decision within 24 hour. Borrowers will be able to view their loan status online after they have received approval.

FAQ

What side hustles are the most profitable?

Side hustle is a term used to describe any side income streams that can supplement your main source.

Side hustles are important because they make it possible to earn extra money for fun activities as well as bills.

In addition, side hustles also help you save more money for retirement, give you time flexibility, and may even increase your earning potential.

There are two types: active and passive side hustles. Side hustles that are passive include side businesses such as blogging, e-commerce and freelancing. Some of the active side hustles are tutoring, dog walking and selling eBay items.

Side hustles that are right for you fit in your daily life. If you love working out, consider starting a fitness business. Consider becoming a freelance landscaper, if you like spending time outdoors.

You can find side hustles anywhere. Find side hustle opportunities wherever you are already spending your time, whether that's volunteering or learning.

For example, if you have experience in graphic design, why not open your own graphic design studio? Perhaps you are a skilled writer, why not open your own graphic design studio?

Be sure to research thoroughly before you start any side hustle. If the opportunity arises, this will allow you to be prepared to seize it.

Remember, side hustles aren't just about making money. Side hustles are about creating wealth and freedom.

There are many ways to make money today so there's no reason not to start one.

How to build a passive income stream?

To earn consistent earnings from the same source, it is important to understand why people make purchases.

It is important to understand people's needs and wants. You must learn how to connect with people and sell to them.

Then you have to figure out how to convert leads into sales. Finally, you must master customer service so you can retain happy clients.

This is something you may not realize, but every product or service needs a buyer. And if you know who that buyer is, you can design your entire business around serving him/her.

A lot of work is required to become a millionaire. To become a billionaire, it takes more effort. Why? Why?

Finally, you can become a millionaire. The final step is to become a millionaire. The same is true for becoming billionaire.

How does one become billionaire? Well, it starts with being a thousandaire. You only need to begin making money in order to reach this goal.

Before you can start making money, however, you must get started. So let's talk about how to get started.

What is the easiest way to make passive income?

There are many online ways to make money. However, most of these require more effort and time than you might think. How do you find a way to earn more money?

The answer is to find something you love, whether blogging, writing, designing, selling, marketing, etc. You can then monetize your passion.

For example, let's say you enjoy creating blog posts. You can start a blog that shares useful information about topics in your niche. When readers click on those links, sign them up to your email list or follow you on social networks.

This is known as affiliate marketing and you can find many resources to help get started. Here's a collection of 101 affiliate marketing tips & resources.

A blog could be another way to make passive income. This time, you'll need a topic to teach about. However, once you've established your site, you can monetize it by offering courses, ebooks, videos, and more.

There are many online ways to make money, but the easiest are often the best. If you really want to make money online, focus on building websites or blogs that provide useful information.

Once you've built your website, promote it through social media sites like Facebook, Twitter, LinkedIn, Pinterest, Instagram, YouTube and more. This is called content marketing, and it's a great method to drive traffic to your website.

Why is personal finance important?

For anyone to be successful in life, financial management is essential. Our world is characterized by tight budgets and difficult decisions about how to spend it.

So why do we put off saving money? What is the best thing to do with our time and energy?

Yes and no. Yes, because most people feel guilty when they save money. You can't, as the more money that you earn, you have more investment opportunities.

If you can keep your eyes on what is bigger, you will always be able spend your money wisely.

Controlling your emotions is key to financial success. You won't be able to see the positive aspects of your situation and will have no support from others.

Your expectations regarding how much money you'll eventually accumulate may be unrealistic. You don't know how to properly manage your finances.

These skills will allow you to move on to the next step: learning how to budget.

Budgeting is the practice of setting aside some of your monthly income for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

Now that you understand how to best allocate your resources, it is possible to start looking forward to a better financial future.

What is personal finances?

Personal finance is about managing your own money to achieve your goals at home and work. This includes understanding where your money is going and knowing how much you can afford. It also involves balancing what you want against what your needs are.

Learning these skills will make you financially independent. You won't need to rely on anyone else for your needs. You can forget about worrying about rent, utilities, or any other monthly bills.

It's not enough to learn how money management can help you make more money. It makes you happier. You will feel happier about your finances and be more satisfied with your life.

Who cares about personal finances? Everyone does! The most searched topic on the Internet is personal finance. Google Trends has shown that searches for personal finance have increased 1,600% from 2004 to 2014.

People use their smartphones today to manage their finances, compare prices and build wealth. These people read blogs like this one and watch YouTube videos about personal finance. They also listen to podcasts on investing.

Bankrate.com estimates that Americans spend on average 4 hours per day viewing TV, listening to music and playing video games, as well reading books and talking with friends. There are only two hours each day that can be used to do all the important things.

Financial management will allow you to make the most of your financial knowledge.

How much debt can you take on?

It is essential to remember that money is not unlimited. You will eventually run out money if you spend more than your income. Because savings take time to grow, it is best to limit your spending. When you run out of money, reduce your spending.

But how much is too much? There is no universal number. However, the rule of thumb is that you should live within 10%. That way, you won't go broke even after years of saving.

If you earn $10,000 per year, this means you should not spend more than $1,000 per month. Spend less than $2,000 per monthly if you earn $20,000 a year. Spend no more than $5,000 a month if you have $50,000.

It is important to get rid of debts as soon as possible. This includes student loans and credit card bills. You'll be able to save more money once these are paid off.

It would be best if you also considered whether or not you want to invest any of your surplus income. If the stock market drops, your money could be lost if you put it towards bonds or stocks. If you save your money, interest will compound over time.

For example, let's say you set aside $100 weekly for savings. Over five years, that would add up to $500. You'd have $1,000 saved by the end of six year. In eight years, your savings would be close to $3,000 In ten years you would have $13,000 in savings.

After fifteen years, your savings account will have $40,000 left. That's pretty impressive. However, this amount would have earned you interest if it had been invested in stock market during the exact same period. Instead of $40,000 in savings, you would have more than 57,000.

You need to be able to manage your finances well. You might end up with more money than you expected.

Statistics

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

External Links

How To

How to Make Money While You Are Asleep

Online success requires that you learn to sleep well while awake. This means more than waiting for someone to click on the link or buy your product. It is possible to make money while you are sleeping.

This requires you to create an automated system that makes money without you having to lift a finger. You must learn the art of automation to do this.

It would be beneficial to learn how to build software systems that do tasks automatically. By doing this, you can make money while you sleep. You can even automate the tasks you do.

It is best to keep a running list of the problems you face each day to help you find these opportunities. Next, ask yourself if there are any ways you could automate them.

Once you've done that, you'll probably realize that you already have dozens of potential ways to generate passive income. You now need to decide which one would be the most profitable.

You could, for example, create a website builder that automates creating websites if you are webmaster. Or if you are a graphic designer, perhaps you could create templates that can be used to automate the production of logos.

You could also create software programs that allow you to manage multiple clients at once if your business is established. There are hundreds to choose from.

Automating a problem can be done as long as you have a creative solution. Automation is the key to financial freedom.