Consolidating your debts is a good way to lower your debt. The process requires a change in behavior. It is necessary to set a budget and limit your credit cards spending. This will help reduce your debt, and allow you to pay off your credit card debt. You may also want to consider getting a personal loan.

Peer-to-peer lending

Peer to peer lending can be a good option to consolidate your debts, especially if you're dealing with high interest rate loans. These loans come with fixed interest rates, and have a set payoff date. But before you take out this type of loan, there are some important things to keep in your mind.

Peer-to-peer loans work by connecting borrowers with investors. They were especially popular after the financial crisis of 2008 when people with poor credit had fewer options. While peer-to-peer lending began with individual investors, it has now expanded into institutional lending. LendingClub will no longer allow individual investors to invest on its loans. However, there are still opportunities for individuals to invest on fractions of these loans through other sites like Prosper.

Personal

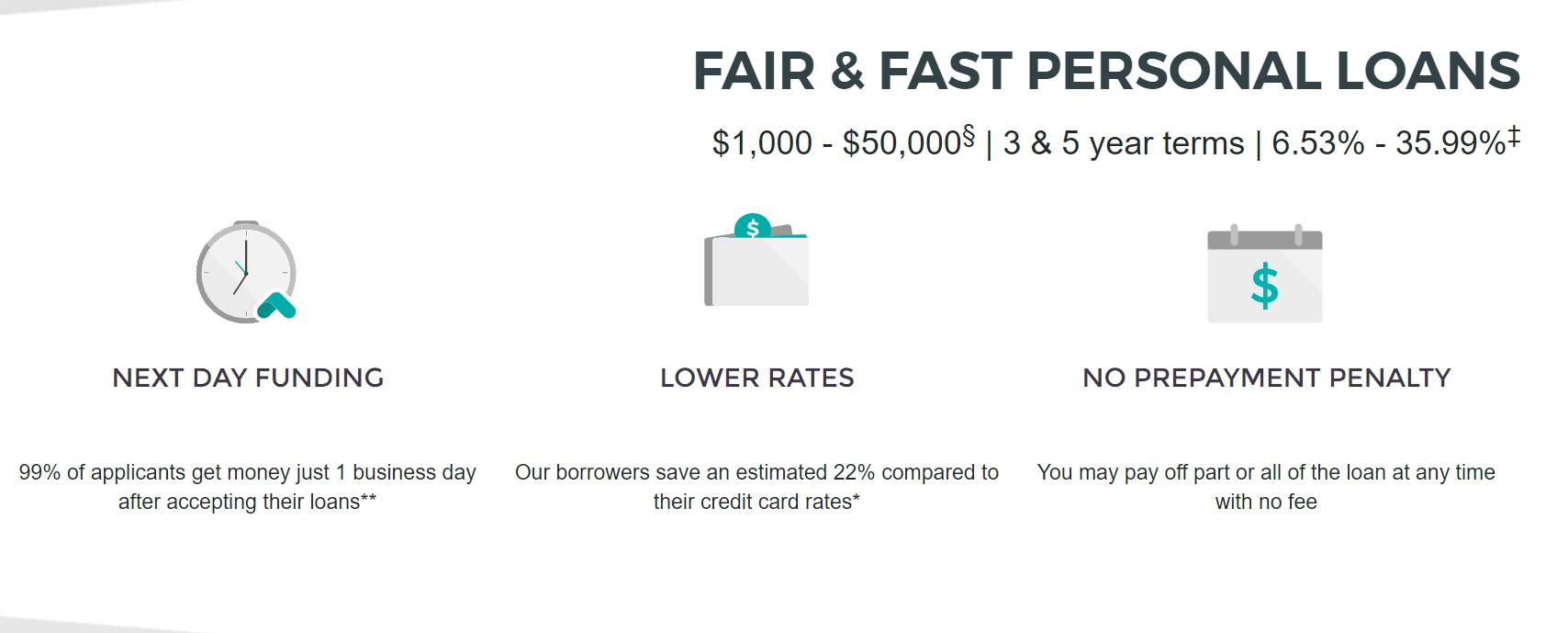

A personal loan is a good option for those looking to consolidate their debts, but be sure to consider the fees and rates of different lenders before deciding to take out a loan. Consider the minimum and maximum interest rates, rate discounts, and prepayment penalties. A personal loan typically has a repayment term of one to seven years.

You can use a fixed-rate consolidation loan to pay off variable-rate debt more quickly. Personal loans allow you to create a repayment plan and know when your debt will be paid off.

Home equity lines credit

A home equity line can be used to secure your home. To pay down debts you can borrow as much as 85% of the equity from your home. Borrowers need to be aware of the potential risks associated with borrowing against equity in their home. Your home could be taken away if you fail to make your payments on time. A home equity loan requires additional payments such as a closing cost and an appraisal. Repaying a home equity loan may take as long as 30 years.

A home equity card is an excellent way to consolidate your debt. It is secured against the home's equity, so interest rates are lower that unsecured debt. Borrowing against home equity can have additional risks but it can also make it simpler to repay your debts.

Consolidating credit cards

For those with credit card debt, consolidation loans are a great solution. Before you sign up for one, however, there are some things that you need to remember. One, you must have a good income and credit score. As this will help you to qualify for a lower loan rate and terms, you should consider having a coborrower.

Consolidating your debt can be one of the most effective ways to control your finances and get rid of it. Credit card consolidation has two main goals: to simplify your finances, and to lower your expenses. There are a number of different methods for doing this, and each method may be best for you.

FAQ

How to create a passive income stream

To consistently earn from one source, you need to understand why people buy what is purchased.

It is important to understand people's needs and wants. You need to know how to connect and sell to people.

Next, you need to know how to convert leads to sales. To keep clients happy, you must be proficient in customer service.

You may not realize this, but every product or service has a buyer. And if you know who that buyer is, you can design your entire business around serving him/her.

It takes a lot of work to become a millionaire. To become a billionaire, it takes more effort. Why? To become a millionaire you must first be a thousandaire.

You can then become a millionaire. You can also become a billionaire. It is the same for becoming a billionaire.

How can someone become a billionaire. It all starts with becoming a millionaire. To achieve this, all you have to do is start earning money.

But before you can begin earning money, you have to get started. Let's discuss how to get started.

What is the easiest passive source of income?

There are many online ways to make money. Some of these take more time and effort that you might realize. So how do you create an easy way for yourself to earn extra cash?

Finding something you love is the key to success, be it writing, selling, marketing or designing. It is possible to make money from your passion.

For example, let's say you enjoy creating blog posts. Your blog will provide useful information on topics relevant to your niche. You can then sign up your readers for email or social media by inviting them to click on the links contained in your articles.

This is called affiliate marketing, and there are plenty of resources to help you get started. Here's a collection of 101 affiliate marketing tips & resources.

You might also think about starting a blog to earn passive income. You'll need to choose a topic that you are passionate about teaching. However, once your site is established, you can make it more profitable by offering ebooks, videos and courses.

While there are many methods to make money online there are some that are more effective than others. You can make money online by building websites and blogs that offer useful information.

Once you've built your website, promote it through social media sites like Facebook, Twitter, LinkedIn, Pinterest, Instagram, YouTube and more. This is known content marketing.

How much debt is too much?

It is essential to remember that money is not unlimited. If you spend more than you earn, you'll eventually run out of cash because it takes time for savings to grow. You should cut back on spending if you feel you have run out of cash.

But how much can you afford? Although there's no exact number that will work for everyone, it is a good rule to aim to live within 10%. That way, you won't go broke even after years of saving.

This means that, if you have $10,000 in a year, you shouldn’t spend more monthly than $1,000. You shouldn't spend more that $2,000 monthly if your income is $20,000 Spend no more than $5,000 a month if you have $50,000.

It is important to get rid of debts as soon as possible. This includes student loans and credit card bills. Once these are paid off, you'll still have some money left to save.

It is best to consider whether or not you wish to invest any excess income. You could lose your money if you invest in stocks or bonds. If you save your money, interest will compound over time.

Consider, for example: $100 per week is a savings goal. In five years, this would add up to $500. After six years, you would have $1,000 saved. In eight years you would have almost $3,000 saved in the bank. When you turn ten, you will have almost $13,000 in savings.

At the end of 15 years, you'll have nearly $40,000 in savings. That's pretty impressive. You would earn interest if the same amount had been invested in the stock exchange during the same period. You'd have more than $57,000 instead of $40,000

That's why it's important to learn how to manage your finances wisely. Otherwise, you might wind up with far more money than you planned.

What is the fastest way to make money on a side hustle?

If you want money fast, you will need to do more than simply create a product/service to solve a problem.

You need to be able to make yourself an authority in any niche you choose. It means building a name online and offline.

Helping people solve problems is the best way build a reputation. So you need to ask yourself how you can contribute value to the community.

Once you have answered this question, you will be able immediately to determine which areas are best suited for you. There are countless ways to earn money online, and even though there are plenty of opportunities, they're often very competitive.

But when you look closely, you can see two main side hustles. One type involves selling products and services directly to customers, while the other involves offering consulting services.

Each approach has its advantages and disadvantages. Selling products or services gives you instant satisfaction because you get paid immediately after you have shipped your product.

But, on the other hand, you might not have the success you desire if you do not spend the time to build relationships with potential clientele. Additionally, there is intense competition for these types of gigs.

Consulting allows you to grow your business without worrying about shipping products or providing services. But it takes longer to establish yourself as an expert in your field.

If you want to succeed at any of the options, you have to learn how identify the right clients. It takes some trial and error. But, in the end, it pays big.

What is personal finance?

Personal finance is the art of managing your own finances to help you achieve your financial goals. It is about understanding your finances, knowing your budget, and balancing your desires against your needs.

Learning these skills will make you financially independent. You won't need to rely on anyone else for your needs. You're free from worrying about paying rent, utilities, and other bills every month.

It's not enough to learn how money management can help you make more money. You'll be happier all around. Feeling good about your finances will make you happier, more productive, and allow you to enjoy your life more.

Who cares about personal finances? Everyone does! Personal finance is a very popular topic today. Google Trends indicates that search terms for "personal finance” have seen a 1,600% increase in searches between 2004-2014.

Today's smartphone users use their phones to compare prices, track budgets and build wealth. These people read blogs like this one and watch YouTube videos about personal finance. They also listen to podcasts on investing.

Bankrate.com reports that Americans spend four hours a days watching TV, listening, playing music, playing video games and surfing the web, as well as talking with their friends. This leaves just two hours per day for all other important activities.

Financial management will allow you to make the most of your financial knowledge.

What are the most profitable side hustles in 2022?

You can make money by creating value for someone else. If you do this well the money will follow.

You may not realize it now, but you've been creating value since day 1. You sucked your mommy’s breast milk as a baby and she gave life to you. Learning to walk gave you a better life.

You'll continue to make more if you give back to the people around you. In fact, the more you give, the more you'll receive.

Without even realizing it, value creation is a powerful force everyone uses every day. You create value every day, whether you are cooking for your family, driving your children to school, emptying the trash or just paying the bills.

There are actually nearly 7 billion people living on Earth today. Each person creates an incredible amount of value every day. Even if only one hour is spent creating value, you can create $7 million per year.

You could add $100 per week to someone's daily life if you found ten more. That would make you an additional $700,000 annually. Think about that - you would be earning far more than you currently do working full-time.

Let's suppose you wanted to increase that number by doubling it. Let's suppose you find 20 ways to increase $200 each month in someone's life. Not only would you make an additional $14.4million dollars per year, but you'd also become extremely wealthy.

Every day offers millions of opportunities to add value. This includes selling products, ideas, services, and information.

Although our focus is often on income streams and careers, these are not the only things that matter. The real goal is to help other people achieve their goals.

Create value to make it easier for yourself and others. Start by downloading my free guide, How to Create Value and Get Paid for It.

Statistics

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

External Links

How To

How passive income can improve cash flow

There are many online ways to make extra money without any hard work. Instead, passive income can be made from your home.

Automation could also be beneficial for an existing business. If you are thinking of starting a business, you might find that automating parts of your workflow can help you save time and increase productivity.

Your business will become more efficient the more it is automated. This means you will be able to spend more time working on growing your business rather than running it.

A great way to automate tasks is to outsource them. Outsourcing lets you focus on the most important aspects of your business. When you outsource a task, it is effectively delegating the responsibility to another person.

This means that you can focus on the important aspects of your business while allowing someone else to manage the details. Because you don't have to worry so much about the details, outsourcing makes it easier for your business to grow.

Another option is to turn your hobby into a side hustle. A side hustle is another option to generate additional income.

You might consider writing articles if you are a writer. There are plenty of sites where you can publish your articles. These websites allow you to make additional monthly cash by paying per article.

Making videos is also possible. Many platforms let you upload videos directly to YouTube and Vimeo. These videos will bring traffic to your site and social media pages.

Investing in stocks and shares is another way to make money. Investing stocks and shares is similar investment to real estate. You are instead paid rent. Instead, you receive dividends.

As part of your payout, shares you have purchased are given to shareholders. The amount of dividend you receive depends on the stock you have.

If you decide to sell your shares, you will be able to reinvest the proceeds into new shares. You will keep receiving dividends for as long as you live.