Collectors will often negotiate with you if you make large lump-sum payments. They will usually accept an offer if you are able to pay more than the minimum amount and may give you a discount. It's important for you to get the payment arrangement in writing when you negotiate a debt collector. Use of abusive or demeaning language is not allowed.

Avoiding bogus debt collectors

It is important that you don't fall for the trap of being taken advantage by a debt collector when you are negotiating with them. The first step is to verify the identity of the debt collector. Legitimate debt collection agents will provide their name and contact information. It is important to be suspicious of any debt collector who asks for personal details, such as account numbers. These information could be used to steal identity.

The second step is to identify which debt is being collected. This is important as many debt collectors may try to collect fraudulent debts such as debts that have already been paid. It is important to avoid debt collectors who threaten to garnish wages and put you in jail. Although these threats are not legal, they can be annoying.

Avoiding abusive or foul language from debt collectors

You should not use abusive or degrading language when you try to negotiate with a debt collector. Harassing a person with abusive or foul language is a violation of the law. Debt collectors shouldn't call you repeatedly or make abusive or obscene statements. These actions can be used against a person in a later suit.

When you are negotiating with a debt collector make sure that you fully understand your legal rights. A lawsuit could be filed against you if abuse is committed. Most cases allow you to file a lawsuit within one year of the violation. When dealing with debt collectors, you should also include all the relevant information, such as the original creditor's name, the means of repayment, and any discrepancy.

Sample letters to send to a debt collector

There are a variety of ways to respond to debt collectors. You can speak to a representative by phone first, but you can also write a letter establishing an agreement. Send the letter certified mail to ensure delivery. Depending on your circumstances, the sample letter you use can vary in length, content, and format.

It is important to include the debtor's name, the amount owed and the due date when writing the letter. You should also include instructions for how to pay your debt. If you cannot pay the debt within five business days, the collector must send you validation letters. This letter must contain more information than the initial contact and the same information.

Limiting your offer to a lumpsum payment

A lump-sum payment is a good option if you are considering negotiating with debt collectors to settle a credit card debt. A debt collector might try to convince you to pay more than you can afford. Don't be misled. There are many options to get out debt. Limiting your lump-sum offer is one of them.

First, understand that negotiations with debt collectors are not the same for all agencies. For example, some collection agencies may settle for half the amount while others insist that they receive the full amount. Don't forget that collection agencies don’t want to waste money on a deadlock.

FAQ

How do rich people make passive income?

There are two main ways to make money online. One way is to produce great products (or services) for which people love and pay. This is called earning money.

You can also find ways to add value to others, without having to spend your time creating products. This is known as "passive income".

Let's say that you own an app business. Your job is to create apps. But instead of selling the apps to users directly, you decide that they should be given away for free. Because you don't rely on paying customers, this is a great business model. Instead, advertising revenue is your only source of income.

To help you pay your bills while you build your business, you may also be able to charge customers monthly.

This is how the most successful internet entrepreneurs make money today. They give value to others rather than making stuff.

What is the limit of debt?

It's essential to keep in mind that there is such a thing as too much money. Spending more than what you earn can lead to cash running out. This is because savings takes time to grow. Spend less if you're running low on cash.

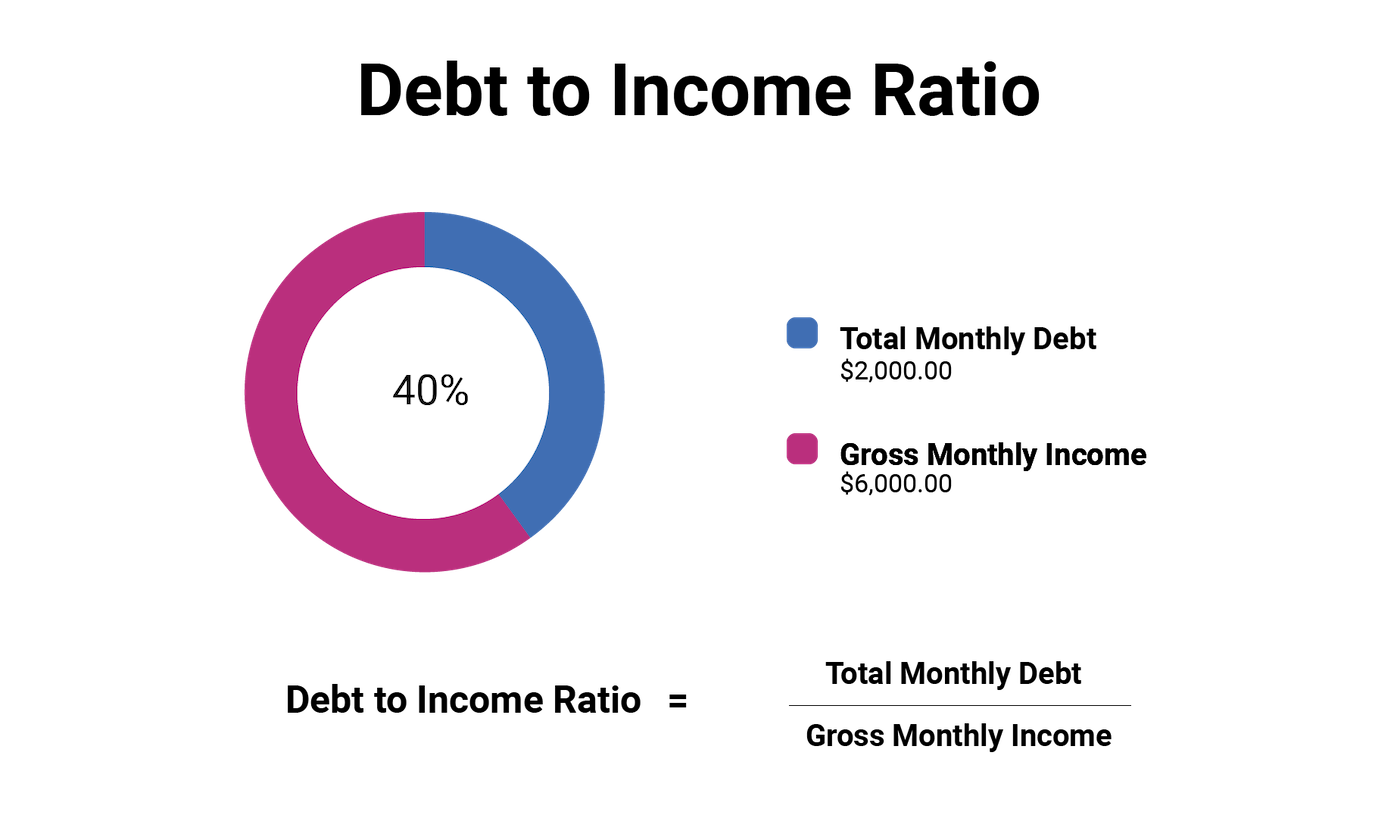

But how much can you afford? There's no right or wrong number, but it is recommended that you live within 10% of your income. You won't run out of money even after years spent saving.

This means that you shouldn't spend more money than $10,000 a year if your income is $10,000. You shouldn't spend more that $2,000 monthly if your income is $20,000 And if you make $50,000, you shouldn't spend more than $5,000 per month.

It's important to pay off any debts as soon and as quickly as you can. This includes student loans, credit cards, car payments, and student loans. You'll be able to save more money once these are paid off.

It's best to think about whether you are going to invest any of the surplus income. If the stock market drops, your money could be lost if you put it towards bonds or stocks. You can still expect interest to accrue if your money is saved.

Let's take, for example, $100 per week that you have set aside to save. Over five years, that would add up to $500. After six years, you would have $1,000 saved. You would have $3,000 in your bank account within eight years. By the time you reach ten years, you'd have nearly $13,000 in savings.

You'll have almost $40,000 sitting in your savings account at the end of fifteen years. This is quite remarkable. But if you had put the same amount into the stock market over the same time period, you would have earned interest. You'd have more than $57,000 instead of $40,000

It's crucial to learn how you can manage your finances effectively. You might end up with more money than you expected.

What is personal financial planning?

Personal finance is the art of managing your own finances to help you achieve your financial goals. It is about understanding your finances, knowing your budget, and balancing your desires against your needs.

If you master these skills, you can be financially independent. This means you are no longer dependent on anyone to take care of you. You no longer have to worry about paying rent or utilities every month.

And learning how to manage your money doesn't just help you get ahead. It can make you happier. You will feel happier about your finances and be more satisfied with your life.

So who cares about personal finance? Everyone does! Personal finance is one of the most popular topics on the Internet today. Google Trends indicates that search terms for "personal finance” have seen a 1,600% increase in searches between 2004-2014.

People use their smartphones today to manage their finances, compare prices and build wealth. You can read blogs such as this one, view videos on YouTube about personal finances, and listen to podcasts that discuss investing.

In fact, according to Bankrate.com, Americans spend an average of four hours a day watching TV, listening to music, playing video games, surfing the Web, reading books, and talking with friends. Only two hours are left each day to do the rest of what is important.

If you are able to master personal finance, you will be able make the most of it.

What is the difference between passive income and active income?

Passive income can be defined as a way to make passive income without any work. Active income requires hard work and effort.

If you are able to create value for somebody else, then that's called active income. It is when someone buys a product or service you have created. Examples include creating a website, selling products online and writing an ebook.

Passive income is great because it allows you to focus on more important things while still making money. Most people don't want to work for themselves. Instead, they decide to focus their energy and time on passive income.

Problem is, passive income won't last forever. If you are not quick enough to start generating passive income you could run out.

Also, you could burn out if passive income is not generated in a timely manner. So it's best to start now. If you wait too long to begin building passive income you will likely miss out on potential opportunities to maximize earnings.

There are three types or passive income streams.

-

These include starting a business, owning a franchise or becoming a freelancer. You could also rent the property, such as real-estate, to other people.

-

These include stocks and bonds and mutual funds. ETFs are also investments.

-

Real estate - This includes buying and flipping homes, renting properties, and investing in commercial real property.

Why is personal finance important?

A key skill to any success is personal financial management. We live in a world where money is tight, and we often have to make difficult decisions about how to spend our hard-earned cash.

So why do we put off saving money? Is there anything better to spend our energy and time on?

Both yes and no. Yes, as most people feel guilty about saving their money. You can't, as the more money that you earn, you have more investment opportunities.

You'll always be able justify spending your money wisely if you keep your eyes on the bigger picture.

Financial success requires you to manage your emotions. Negative thoughts will keep you from having positive thoughts.

Also, you may have unrealistic expectations about the amount of money that you will eventually accumulate. You don't know how to properly manage your finances.

After mastering these skills, it's time to learn how to budget.

Budgeting is the act or practice of setting aside money each month to pay for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

Now that you are able to effectively allocate your resources, you can look forward to a brighter future.

Which side hustles are most lucrative?

Side hustles are income streams that add to your primary source of income.

Side hustles are important because they make it possible to earn extra money for fun activities as well as bills.

Side hustles may also allow you to save more money for retirement and give you more flexibility in your work schedule. They can even help you increase your earning potential.

There are two types. Online businesses like e-commerce, blogging, and freelance work are all passive side hustles. Active side hustles include jobs such as dog walking, tutoring, and selling items on eBay.

Side hustles that work for you are easy to manage and make sense. If you love working out, consider starting a fitness business. You might consider working as a freelance landscaper if you love spending time outdoors.

Side hustles can be found everywhere. Look for opportunities where you already spend time -- whether it's volunteering or taking classes.

One example is to open your own graphic design studio, if graphic design experience is something you have. Maybe you're a writer and want to become a ghostwriter.

Whatever side hustle you choose, be sure to do thorough research and planning ahead of time. When the opportunity presents itself, be prepared to jump in and seize it.

Side hustles aren’t about making more money. They're about building wealth and creating freedom.

There are so many opportunities to make money that you don't have to give up, so why not get one?

Statistics

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

External Links

How To

How to make money when you're sleeping

You must be able to fall asleep while you're awake if you want to make it big online. This means learning to do more than wait for someone to click on your link or buy your product. You must make money while you sleep.

This means you must create an automated system to make money, without even lifting a finger. To do that, you must master the art of automation.

It would help if you became an expert at building software systems that perform tasks automatically. This will allow you to focus on your business while you sleep. You can even automate your job.

To find these opportunities, you should create a list with problems that you solve every day. Ask yourself if you can automate these problems.

Once you do that, you will probably find that there are many other ways to make passive income. Now, it's time to find the most lucrative.

A website builder, for instance, could be developed by a webmaster to automate the creation of websites. You might also be able to create templates for logo production that you can use in an automated way if you're a graphic designer.

Or, if you own a business, perhaps you could create a software program that allows you to manage multiple clients simultaneously. There are many possibilities.

You can automate anything as long you can think of a solution to a problem. Automation is the key for financial freedom.