This article will explain how to calculate your credit ratio, the criteria lenders use for determining your borrowing power, and the effects of a high credit ratio on your credit score. It also discusses some ways to reduce your debt ratio. We hope this information helps you make the best borrowing decision possible. Let's not forget about the common reasons for high credit debt.

Calculating a credit debt ratio

Lenders use their credit to debt ratios to assess whether you are a candidate for a loan. They prefer to see this ratio below 30%. Higher ratios will indicate that you are a risky borrower. It can also hurt your score. You can lower your debt to credit ratio and avoid the negative effects of high ratios.

Reduce your debt to credit ratio and pay down your credit cards. By keeping balances lower than 30% of your total credit line, you'll increase your credit score. Paying off balances should be your priority. If you want to make wise decisions regarding borrowing or buying credit, it is important that your debt-to credit ratio is low. Monitor your ratio to see if you can make more than the minimum payment.

Lenders use a variety of criteria to determine borrowing ability

Lenders evaluate a borrower's credit score as well as his financial status to determine their borrowing capacity. The higher the score, the higher the borrowing power. Higher scores mean you can borrow more money and receive better interest rates. Regardless of credit score, however, there are some things you need to consider before applying for a loan.

Analyzing the borrower's income is the first step in determining his or her borrowing power. The real-life serviceability calculation is used for this purpose. This calculator works in the same way as most banks. Next, you will need to decide if the borrower is able to make the monthly payments.

Credit score can be affected by high levels of debt

The most important factor that affects a person’s credit score is the debt-to–credit ratio. The lower your debt-to-credit ratio, the better. A goal is to keep your ratio below 10%. Obviously, a low ratio doesn't mean you can't use credit responsibly. High ratios may be an indicator that you aren’t managing your finances correctly.

Credit scoring also considers credit utilization ratio. This is a measure of how much credit you have available. A high debt-to-credit ratio will negatively impact your score, so make sure you're not maxing out your cards. It's better to have a low utilization rate and a low debt-to-credit ratio to maintain a good credit score.

You can lower it.

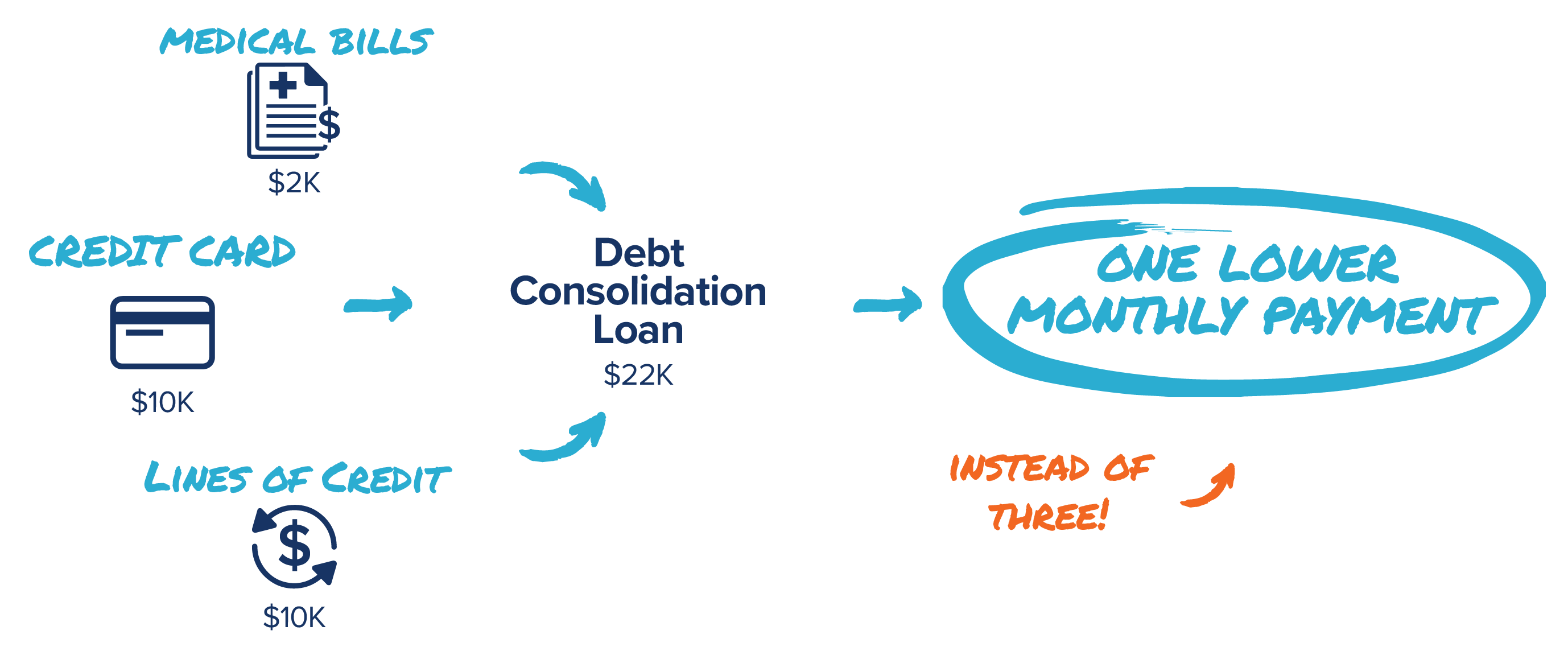

There are many ways you can lower your credit ratio (DTI) or credit score. To avoid more debt, the first step is to stop taking it on. Your DTI will only increase if you have more debt. You can avoid this by only applying to what you really need. You can use a debt snowball tool to find out which debts you are able to pay first. For a reduced amount of debt, debt consolidation is also an option.

You can also work towards increasing your income. While a high debt-to-income ratio might make sense if you're aggressively paying off your debt, it's not healthy if you're only making minimum payments. An excellent way to increase your income would be to find a job or raise your salary. These methods will increase your income, but not your monthly debt payments.

FAQ

What is the fastest way to make money on a side hustle?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

It is also important to establish yourself as an authority in the niches you choose. It is important to establish a good reputation online as well offline.

Helping other people solve their problems is the best way for a person to earn a good reputation. It is important to consider how you can help the community.

After answering that question, it's easy to identify the areas in which you are most qualified to work. There are many ways to make money online.

You will see two main side hustles if you pay attention. The one involves selling direct products and services to customers. While the other involves providing consulting services.

There are pros and cons to each approach. Selling products or services gives you instant satisfaction because you get paid immediately after you have shipped your product.

You might not be able to achieve the success you want if you don't spend enough time building relationships with potential clients. Additionally, there is intense competition for these types of gigs.

Consulting helps you grow your company without worrying about shipping goods or providing service. But, it takes longer to become an expert in your chosen field.

In order to succeed at either option, you need to learn how to identify the right clientele. This can take some trial and error. But in the long run, it pays off big time.

What is the difference between passive and active income?

Passive income means that you can make money with little effort. Active income requires hard work and effort.

If you are able to create value for somebody else, then that's called active income. You earn money when you offer a product or service that someone needs. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income can be a great option because you can put your efforts into more important things and still make money. Most people aren’t keen to work for themselves. People choose to work for passive income, and so they invest their time and effort.

Passive income isn't sustainable forever. If you are not quick enough to start generating passive income you could run out.

Also, you could burn out if passive income is not generated in a timely manner. It's better to get started now than later. If you wait too long to begin building passive income you will likely miss out on potential opportunities to maximize earnings.

There are three types of passive income streams:

-

These include starting a business, owning a franchise or becoming a freelancer. You could also rent the property, such as real-estate, to other people.

-

Investments - These include stocks, bonds and mutual funds as well ETFs.

-

Real estate - This includes buying and flipping homes, renting properties, and investing in commercial real property.

Why is personal finance important?

A key skill to any success is personal financial management. We live in a world where money is tight, and we often have to make difficult decisions about how to spend our hard-earned cash.

So why should we wait to save money? What is the best thing to do with our time and energy?

Yes and no. Yes, because most people feel guilty when they save money. It's not true, as more money means more opportunities to invest.

If you can keep your eyes on what is bigger, you will always be able spend your money wisely.

Controlling your emotions is key to financial success. If you are focusing on the negative aspects of your life, you will not have positive thoughts that can support you.

It is possible to have unrealistic expectations of how much you will accumulate. This is because you haven't learned how to manage your finances properly.

Once you've mastered these skills, you'll be ready to tackle the next step - learning how to budget.

Budgeting means putting aside a portion every month for future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

Now that you are able to effectively allocate your resources, you can look forward to a brighter future.

How to create a passive income stream

To generate consistent earnings from one source, you have to understand why people buy what they buy.

That means understanding their needs and wants. You need to know how to connect and sell to people.

Next, you need to know how to convert leads to sales. Finally, you must master customer service so you can retain happy clients.

Even though it may seem counterintuitive, every product or service has its buyer. If you know the buyer, you can build your entire business around him/her.

It takes a lot of work to become a millionaire. It takes even more to become billionaire. Why? It is because you have to first become a 1,000aire before you can become a millionaire.

Then, you will need to become millionaire. You can also become a billionaire. The same goes for becoming a billionaire.

How does one become a billionaire, you ask? It starts with being a millionaire. All you have to do in order achieve this is to make money.

But before you can begin earning money, you have to get started. Let's take a look at how we can get started.

How much debt are you allowed to take on?

It is essential to remember that money is not unlimited. Spending more than what you earn can lead to cash running out. This is because savings takes time to grow. You should cut back on spending if you feel you have run out of cash.

But how much do you consider too much? Although there's no exact number that will work for everyone, it is a good rule to aim to live within 10%. Even after years of saving, this will ensure you won't go broke.

This means that, if you have $10,000 in a year, you shouldn’t spend more monthly than $1,000. You shouldn't spend more that $2,000 monthly if your income is $20,000 Spend no more than $5,000 a month if you have $50,000.

Paying off your debts quickly is the key. This includes student loans and credit card bills. Once these are paid off, you'll still have some money left to save.

It is best to consider whether or not you wish to invest any excess income. You could lose your money if you invest in stocks or bonds. If you save your money, interest will compound over time.

As an example, suppose you save $100 each week. In five years, this would add up to $500. You'd have $1,000 saved by the end of six year. In eight years you would have almost $3,000 saved in the bank. It would take you close to $13,000 to save by the time that you reach ten.

At the end of 15 years, you'll have nearly $40,000 in savings. Now that's quite impressive. You would earn interest if the same amount had been invested in the stock exchange during the same period. Instead of $40,000 you would now have $57,000.

That's why it's important to learn how to manage your finances wisely. Otherwise, you might wind up with far more money than you planned.

What is the easiest way to make passive income?

There are many options for making money online. Some of these take more time and effort that you might realize. How can you make it easy for yourself to make extra money?

Finding something you love is the key to success, be it writing, selling, marketing or designing. and monetize that passion.

For example, let's say you enjoy creating blog posts. Your blog will provide useful information on topics relevant to your niche. When readers click on those links, sign them up to your email list or follow you on social networks.

Affiliate marketing is a term that can be used to describe it. There are many resources available to help you get started. Here are some examples of 101 affiliate marketing tools, tips & resources.

Another option is to start a blog. You'll need to choose a topic that you are passionate about teaching. After you've created your website, you can start offering ebooks and courses to make money.

While there are many methods to make money online there are some that are more effective than others. If you really want to make money online, focus on building websites or blogs that provide useful information.

After you have built your website, make sure to promote it on social media platforms like Facebook, Twitter and LinkedIn. This is content marketing. It's an excellent way to bring traffic back to your website.

Statistics

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

External Links

How To

How To Make Money Online

Today's methods of making money online are very different from those used ten years ago. Your investment strategy is changing. There are many ways that you can make passive income. But, they all require a large initial investment. Some methods are simpler than others. Before you start investing your hard-earned money in any endeavor, you must consider these important points.

-

Find out what kind of investor you are. If you're looking to make quick bucks, you might find yourself attracted to programs like PTC sites (Pay per click), where you get paid for simply clicking ads. However, if long-term earning potential is more important to you, you might consider affiliate marketing opportunities.

-

Do your research. You must research any program before you decide to commit. Check out past performance records and testimonials before you commit to any program. You don't want to waste your time and energy only to realize that the product doesn't work.

-

Start small. Do not jump into a large project. Instead, begin by building something basic first. This will enable you to get the basics down and make a decision about whether or not this type of business is for your. Once you feel confident enough to take on larger projects.

-

Get started now! It's never too late to start making money online. Even if you've been working full-time for years, you still have plenty of time left to build a solid portfolio of profitable niche websites. All you need is a good idea and some dedication. So go ahead and take action today!