There are many options when it comes to consolidating medical bills. These options include unsecured personal financing, inhouse financing, debt negotiation and bankruptcy. To help you choose the right option for you, learn more about each. To avoid future medical expenses, you should first create a savings account. This will save you money and help you not add to your debt.

In-house funding is an option for medical bill consolidation

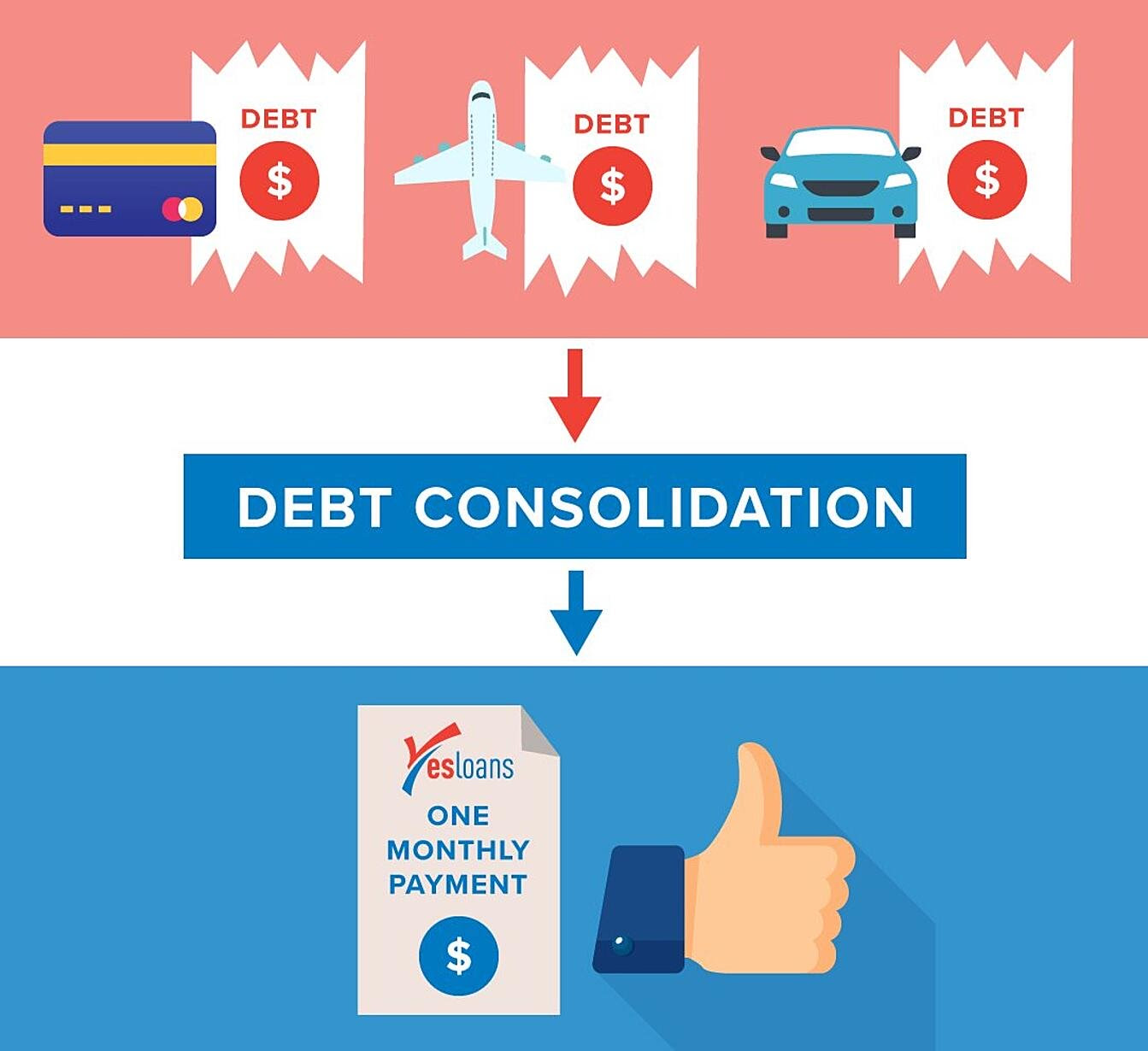

A personal loan, home equity or balance transfer card can be used to consolidate all your medical expenses into one monthly payment. You can also enroll in a debt management plan and your providers will work with you to create a payment plan that fits your budget. Many hospitals and doctors will help you if your financial situation is severe. It is important to get in touch with your providers early to discuss a payment plan. Waiting too long could lead to an increase in the overall cost.

Medical debt consolidation is a great option, but it's not right for everyone. Although it may help you simplify your monthly payments and save money in the short term, it could end up hurting your credit in the long run. It can also negatively impact your credit score.

Unsecured personal loan

A personal loan unsecured may be an option for you if you're having financial difficulties as a result of medical bills. These loans can often be obtained from banks, credit institutions, and online lenders. These loans are available with different interest rates and repayment terms ranging from two to ten decades. Consider this type of loan if you are looking for the lowest interest rate.

To pay off medical bills, another option is to get a secured loan. These loans are typically lower than unsecured loans but you have to make sure you can repay it within a set time. You should also be aware that an unsecure loan can result in a default on you credit report which could harm your credit score.

Debt negotiation

Debt negotiation may be an option if you're struggling to pay your medical bills. It is difficult to negotiate a lower interest rate and monthly payments for your debt. A qualified debt negotiator can help. A debt consolidation loan can be applied for. This will consolidate all of your debts into one loan you can repay over time.

The process of debt negotiation for medical bill consolidation involves negotiating with your creditors. These qualifications must be met. You must be able prove financial hardship. The second requirement is that you are able to defer a portion your other bills into an account. You may not have enough money to cover your bills.

Bankruptcy

Consolidating your medical debt is an option to pay off existing medical debts and avoid bankruptcy. This service is offered by banks, credit unions, online lenders, and other financial institutions to clients who are looking for a financial solution to their problems with medical bills. A medical debt consolidation loan is an unsecured personal loan. The lender cannot use your home or other collateral. Consumers prefer this option because they may be unable to pay the full amount without a loan.

You can choose between Chapter 7 or Chapter 13 to consolidate your medical bills. The former lets you combine your medical bills with other unsecured debt into one single payment. In either case the bankruptcy court will establish a repayment program based on your income and expenses. There are also special relief options available for seniors and veterans.

Counselling in credit for non-profits

Consolidating medical debt can be an option. This consolidation of debt can reduce interest rates on credit card bills. A non-profit credit counseling agency will help you establish a debt management plan which will allow for you to combine your credit card and medical debt.

While these counseling services are often free, some may charge an additional fee. Before you commit to any program, it is important that you know what the fees are. You should find out the cost of any service you are considering before signing up.

FAQ

What are the most profitable side hustles in 2022?

The best way today to make money is to create value in the lives of others. You will make money if you do this well.

It may seem strange, but your creations of value have been going on since the day you were born. You sucked your mommy’s breast milk as a baby and she gave life to you. You made your life easier by learning to walk.

Giving value to your friends and family will help you make more. Actually, the more that you give, the greater the rewards.

Without even realizing it, value creation is a powerful force everyone uses every day. Whether you're cooking dinner for your family, driving your kids to school, taking out the trash, or simply paying the bills, you're constantly creating value.

There are actually nearly 7 billion people living on Earth today. This means that every person creates a tremendous amount of value each day. Even if you only create $1 worth of value per hour, you'd be creating $7 million dollars a year.

You could add $100 per week to someone's daily life if you found ten more. That would make you an additional $700,000 annually. You would earn far more than you are currently earning working full-time.

Let's imagine you wanted to make that number double. Let's suppose you find 20 ways to increase $200 each month in someone's life. You would not only be able to make $14.4 million more annually, but also you'd become very wealthy.

Every day, there are millions upon millions of opportunities to create wealth. This includes selling products, services, ideas, and information.

Even though we focus a lot on careers, income streams, and jobs, these are only tools that can help us achieve our goals. The real goal is to help other people achieve their goals.

Focus on creating value if you want to be successful. You can start by using my free guide: How To Create Value And Get Paid For It.

What's the difference between passive income vs active income?

Passive income is when you earn money without doing any work. Active income requires effort and hard work.

You create value for another person and earn active income. Earn money by providing a service or product to someone. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income is great because you can focus on other important things while still earning money. Most people don't want to work for themselves. They choose to make passive income and invest their time and energy.

Passive income doesn't last forever, which is the problem. If you are not quick enough to start generating passive income you could run out.

In addition to the danger of burnout, if you spend too many hours trying to generate passive income, So it's best to start now. If you wait too long to begin building passive income you will likely miss out on potential opportunities to maximize earnings.

There are three types passive income streams.

-

These include starting a business, owning a franchise or becoming a freelancer. You could also rent the property, such as real-estate, to other people.

-

Investments - These include stocks, bonds and mutual funds as well ETFs.

-

Real Estate includes flipping houses, purchasing land and renting properties.

What is personal financial planning?

Personal finance involves managing your money to meet your goals at work or home. This means understanding where your money goes and what you can afford. And, it also requires balancing the needs of your wants against your financial goals.

These skills will allow you to become financially independent. This means that you won't have to rely on others for your financial needs. You're free from worrying about paying rent, utilities, and other bills every month.

And learning how to manage your money doesn't just help you get ahead. It can make you happier. Feeling good about your finances will make you happier, more productive, and allow you to enjoy your life more.

So, who cares about personal financial matters? Everyone does! Personal finance is one of the most popular topics on the Internet today. Google Trends indicates that search terms for "personal finance” have seen a 1,600% increase in searches between 2004-2014.

People now use smartphones to track their money, compare prices and create wealth. These people read blogs like this one and watch YouTube videos about personal finance. They also listen to podcasts on investing.

Bankrate.com estimates that Americans spend on average 4 hours per day viewing TV, listening to music and playing video games, as well reading books and talking with friends. There are only two hours each day that can be used to do all the important things.

If you are able to master personal finance, you will be able make the most of it.

How to build a passive income stream?

To consistently earn from one source, you need to understand why people buy what is purchased.

It is important to understand people's needs and wants. You must learn how to connect with people and sell to them.

The next step is to learn how to convert leads in to sales. To retain happy customers, you need to be able to provide excellent customer service.

This is something you may not realize, but every product or service needs a buyer. If you know who this buyer is, your entire business can be built around him/her.

It takes a lot of work to become a millionaire. To become a billionaire, it takes more effort. Why? It is because you have to first become a 1,000aire before you can become a millionaire.

Finally, you can become a millionaire. Finally, you must become a billionaire. The same is true for becoming billionaire.

How can someone become a billionaire. It starts with being a millionaire. All you need to do to achieve this is to start making money.

You have to get going before you can start earning money. Let's look at how to get going.

What's the best way to make fast money from a side-hustle?

You can't just create a product that solves someone's problem to make quick money if you want to really make it happen.

Also, you need to figure out a way that will position yourself as an authority on any niche you choose. It is important to establish a good reputation online as well offline.

Helping others solve problems is the best way to establish a reputation. So you need to ask yourself how you can contribute value to the community.

Once you have answered this question, you will be able immediately to determine which areas are best suited for you. Online earning money is possible in many ways. However, these opportunities are often highly competitive.

If you are careful, there are two main side hustles. The first type is selling products and services directly, while the second involves offering consulting services.

Each approach has pros and cons. Selling products or services gives you instant satisfaction because you get paid immediately after you have shipped your product.

But, on the other hand, you might not have the success you desire if you do not spend the time to build relationships with potential clientele. You will also find fierce competition for these gigs.

Consulting helps you grow your company without worrying about shipping goods or providing service. It takes more time to become an expert in your field.

You must learn to identify the right clients in order to be successful at each option. This can take some trial and error. But it will pay off big in the long term.

How do wealthy people earn passive income through investing?

There are two methods to make money online. The first is to create great products or services that people love and will pay for. This is called earning money.

Another way is to create value for others and not spend time creating products. This is what we call "passive" or passive income.

Let's suppose you have an app company. Your job involves developing apps. But instead of selling them directly to users, you decide to give them away for free. This business model is great because it does not depend on paying users. Instead, your advertising revenue will be your main source.

In order to support yourself as you build your company, it may be possible to charge monthly fees.

This is how internet entrepreneurs who are successful today make their money. They are more focused on providing value than creating stuff.

Statistics

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

External Links

How To

How to make money online without any experience

There are many ways to make money online. While some people like to use computers for work, others prefer to be outside and interact with others.

There is always room to improve, no matter who you are. Here we will look at some simple ways to improve your life.

Since its inception, blogging has seen a tremendous growth. Anyone can set up a blog from any computer and make money.

A blog isn't only free but also very simple to set up. You don't need to know much about blogging. All you need is a domain name, and a hosting service.

Selling photos online is one way to make easy money online. It doesn’t really matter what your skills are with photography.

A good digital camera is all that's required. Once you have these things, you can upload images to Fotolia which is a site that millions of people use daily to find high-quality photos for download.

You can sell your skills if you are skilled in a particular area. Online, you will find many opportunities to sell your expertise, no matter what level you are in writing or speaking multiple languages fluently.

One site called Elance connects freelancers with businesses who want to hire their services. People post projects they need help completing, and freelancers bid on them. The project will be completed by the highest bidder.

-

Make an ebook and sell it on Amazon

Amazon is the biggest e-commerce website on the Internet. They offer a marketplace where people can buy and sell items.

This allows you to create an ebook and make it available through Amazon. This is a great choice because you get paid per sales and not per page.

Teaching abroad is another way you can earn extra cash, even if your home country is not the best. Teachers Pay Teachers allows you to connect with teachers who are looking for English lessons.

You can teach any subject including math, science and geography.

-

Google Write Adsense is another popular way to advertise on your website. When someone visits your website, you place small advertisements throughout the pages of the website. These ads are displayed when visitors view any particular webpage.

The more traffic that you get, the more revenue will you make.

Digitally selling artwork is also possible. You can also sell your artwork digitally through sites such as Etsy.

Etsy makes it easy to create virtual shops that look just like real ones.

-

Get a job as a freelancer

Students are becoming more interested in freelance work. As the economy continues to improve, more companies are outsourcing jobs to independent contractors.

It's a win for both employees and employers. Employers are able to save money as they don't have to pay any benefits or payroll taxes. Flexibility in work schedules and additional income for employees is a benefit.