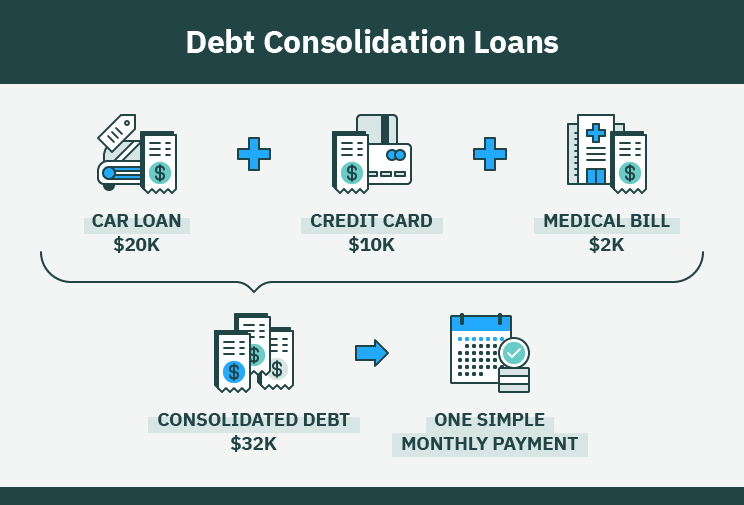

It is important to think smartly about how you can save money while paying off your debt. Other than getting the best mortgage or credit card, there are other ways you can maximize your savings. One way is to get a consolidation loan at a very low interest rate. You will have only one monthly payment and might be eligible for a lower interest rate if you have a better financial situation.

It can seem difficult to balance saving and paying off debt. But it is not impossible. You can save your hard-earned cash and not sacrifice your quality of living with smart financial planning. The benefits could surprise you.

You should create a budget before you can start. A budget is a good way to track your spending habits and keep your frugality in check. After you've determined your monthly expenses, set aside some money for savings. Make sure to set up an emergency savings fund, as well.

It's important to remember that you should be saving to pay off your debts, not just to make a nice sum of cash. Your credit limit should also be kept in mind. Although you may be tempted to max it out, remember that you can't have your cake and eat it too. Your lender should have a periodic statement with the current interest rate.

While paying off your debts is an admirable goal, don't do it all. It is possible to waste time and energy by focusing on this process. Instead, you could focus your efforts on other more productive endeavors. You should take a look at your spending and cut down on the essentials. You'll fall into debt sooner than you think if you don't practice discipline.

For the most part, the biggest saving isn't to be found in the bank. You should instead pay your loans off as soon as possible. You can save money by paying off your loans as soon as possible. This will help reduce interest costs. Your lender may also impose a heavy penalty if your loan payments are not possible.

You're not going to be able to afford to put all your money into a savings account. The goal should be to save at most 10% of your monthly gross earnings. This will eventually grow to a nice nest fund for your retirement.

Smart financial planning combined with discipline is the best way to save money while paying down debt. Although you may be tempted to spend all of your savings on your debts, it is a smart financial decision to preserve your credit limit and save your money for emergencies. Once you have your debts under control, you can invest. Doing so could help you reach higher heights in the long-term.

There are dozens of different financial options to choose from. Traditional banks are your best choice, but you also have options for alternative lenders that offer debt consolidation loans.

FAQ

How to build a passive income stream?

To make consistent earnings from one source you must first understand why people purchase what they do.

It is important to understand people's needs and wants. It is important to learn how to communicate with people and to sell to them.

You must then figure out how you can convert leads into customers. To retain happy customers, you need to be able to provide excellent customer service.

You may not realize this, but every product or service has a buyer. And if you know who that buyer is, you can design your entire business around serving him/her.

A lot of work is required to become a millionaire. It takes even more to become billionaire. Why? It is because you have to first become a 1,000aire before you can become a millionaire.

Then you must become a millionaire. Finally, you must become a billionaire. The same goes for becoming a billionaire.

So how does someone become a billionaire? You must first be a millionaire. All you have to do in order achieve this is to make money.

But before you can begin earning money, you have to get started. Let's look at how to get going.

How can a beginner make passive income?

Start with the basics. Learn how to create value and then discover ways to make a profit from that value.

You might have some ideas. If you do, great! If you do, great!

You can make money online by looking for opportunities that match you skills and interests.

For example, if you love creating websites and apps, there are plenty of opportunities to help you generate revenue while you sleep.

Reviewing products is a great way to express your creativity. Or if you're creative, you might consider designing logos or artwork for clients.

No matter what focus you choose, be sure to find something you like. That way, you'll stick with it long-term.

Once you find a product/service you love helping people buy, it's time to figure out how you can monetize it.

There are two main options. One is to charge a flat rate for your services (like a freelancer), and the second is to charge per project (like an agency).

In either case, once you've set your rates, you'll need to promote them. This means sharing them on social media, emailing your list, posting flyers, etc.

These three tips will help you increase your chances for success when marketing your business.

-

Market like a professional: Always act professional when you do anything in marketing. It is impossible to predict who might be reading your content.

-

Be knowledgeable about the topic you are discussing. After all, no one likes a fake expert.

-

Do not spam. If someone asks for information, avoid sending emails to everyone in your email list. If someone asks for a recommendation, send it directly to them.

-

Make sure to choose a quality email provider. Yahoo Mail, Gmail, and Yahoo Mail are both free.

-

Monitor your results. You can track who opens your messages, clicks links, or signs up for your mail lists.

-

You can measure your ROI by measuring the number of leads generated for each campaign and determining which campaigns are most successful in converting them.

-

Get feedback - Ask your friends and family if they are interested in your services and get their honest feedback.

-

Try different strategies - you may find that some work better than others.

-

Learn new things - Keep learning to be a marketer.

What is the difference between passive and active income?

Passive income refers to making money while not working. Active income is earned through hard work and effort.

Active income is when you create value for someone else. If you provide a service or product that someone is interested in, you can earn money. You could sell products online, write an ebook, create a website or advertise your business.

Passive income allows you to be more productive while making money. However, most people don't like working for themselves. They choose to make passive income and invest their time and energy.

Problem is, passive income won't last forever. You might run out of money if you don't generate passive income in the right time.

You also run the risk of burning out if you spend too much time trying to generate passive income. It's better to get started now than later. If you wait until later to start building passive income, you'll probably miss out on opportunities to maximize your earnings potential.

There are three types passive income streams.

-

Businesses - these include owning a franchise, starting a blog, becoming a freelancer, and renting out the property such as real estate

-

Investments include stocks, bonds, mutual funds, ETFs, and ETFs.

-

Real Estate - this includes rental properties, flipping houses, buying land, and investing in commercial real estate

Which side hustles are the most lucrative in 2022

The best way today to make money is to create value in the lives of others. If you do this well, the money will follow.

You may not realize it now, but you've been creating value since day 1. When you were little, you took your mommy's breastmilk and it gave you life. Your life will be better if you learn to walk.

You'll continue to make more if you give back to the people around you. The truth is that the more you give, you will receive more.

Without even realizing it, value creation is a powerful force everyone uses every day. It doesn't matter if you're cooking dinner or driving your kids to school.

Today, Earth is home for nearly 7 million people. Each person is creating an amazing amount of value every day. Even if you create only $1 per hour of value, you would be creating $7,000,000 a year.

You could add $100 per week to someone's daily life if you found ten more. That would make you an additional $700,000 annually. This is a lot more than what you earn working full-time.

Let's suppose you wanted to increase that number by doubling it. Let's say that you found 20 ways each month to add $200 to someone else's life. You would not only be able to make $14.4 million more annually, but also you'd become very wealthy.

Every single day, there are millions more opportunities to create value. This includes selling ideas, products, or information.

Even though we spend much of our time focused on jobs, careers, and income streams, these are merely tools that help us accomplish our goals. Helping others achieve theirs is the real goal.

You can get ahead if you focus on creating value. My free guide, How To Create Value and Get Paid For It, will help you get started.

What is the easiest passive source of income?

There are many different ways to make online money. Some of these take more time and effort that you might realize. So how do you create an easy way for yourself to earn extra cash?

The solution is to find what you enjoy, blogging, writing or selling. You can then monetize your passion.

For example, let's say you enjoy creating blog posts. Your blog will provide useful information on topics relevant to your niche. You can then sign up your readers for email or social media by inviting them to click on the links contained in your articles.

Affiliate marketing is a term that can be used to describe it. There are many resources available to help you get started. Here are 101 affiliate marketing tips and resources.

A blog could be another way to make passive income. Again, you will need to find a topic which you love teaching. You can also make your site monetizable by creating ebooks, courses and videos.

Although there are many ways to make money online you can choose the easiest. Make sure you focus your efforts on creating useful websites and blogs if you truly want to make a living online.

Once your website is built, you can promote it via social media sites such as Facebook, Twitter, LinkedIn and Pinterest. This is known content marketing.

What side hustles are the most profitable?

Side hustle is a term used to describe any side income streams that can supplement your main source.

Side hustles can be very beneficial because they allow you to make extra money and provide fun activities.

Side hustles are a way to make more money, save time, and increase your earning power.

There are two types side hustles: active and passive. Passive side hustles include online businesses such as e-commerce stores, blogging, and freelancing. You can also do side hustles like tutoring and dog walking.

Side hustles are smart and can fit into your life. A fitness business is a great option if you enjoy working out. If you enjoy spending time outdoors, consider becoming a freelance landscaper.

There are many side hustles that you can do. You can find side hustles anywhere.

If you are an expert in graphic design, why don't you open your own graphic design business? Perhaps you're an experienced writer so why not go ghostwriting?

You should do extensive research and planning before you begin any side hustle. This way, when the opportunity arises, you'll be ready to jump right in and take advantage of it.

Side hustles are not just about making money. They're about building wealth and creating freedom.

And with so many ways to earn money today, there's no excuse to start one!

Statistics

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

External Links

How To

How to Make Money From Home

No matter how much money you make online, there's always room for improvement. Even the most successful entrepreneurs aren't able to grow their business and increase profits.

Problem is, when you are just starting out, it can be easy to get stuck in the rut and focus on revenue instead of growing your business. It could lead to you spending more time on marketing and less on product development. You might even neglect customer service.

It is important to evaluate your progress periodically and ask yourself if you are improving or maintaining your status quo. These five methods can help you increase your income.

-

Increase Your Productivity

Productivity doesn't only revolve around the output. You also have to be able to accomplish tasks effectively. So figure out which parts of your job require the most effort and energy, and delegate those jobs to someone else.

For instance, an eCommerce entrepreneur might hire virtual assistants for customer support, email management, social media and email management.

A team member could be assigned to create blog posts, and another person to manage your lead generation campaigns. Delegating should be done with people who will help you accomplish your goals quicker and better.

-

Marketing should be a secondary focus.

Marketing does not necessarily have to involve spending a lot of money. Some of the most effective marketers aren't even paid employees. They are self-employed consultants, who make commissions on the sale of their services.

Instead of advertising your products via print ads and radio, or TV, consider joining affiliate programs. These programs allow you to promote other businesses' products and services. You don't have to buy the expensive inventory to generate sales.

-

Hire An Expert To Do What You Can't

Hire freelancers if you are lacking expertise in a particular area. A freelance designer could be hired to help you develop graphics for your site, if, for example, you don't know much about graphic design.

-

Get Paid Faster By Using Invoice Apps

Invoicing can be a tedious task when you are a contractor. It's especially tedious when you have multiple clients who each want different things.

But apps like Xero and FreshBooks allow you to invoice customers quickly and easily. All your client information can be entered once and invoices sent directly from the app.

-

Promote More Products with Affiliate Programs

Affiliate programs are great as they allow you to sell products and not have to hold stock. You don't have to worry about shipping costs. You only need to create a link between your site and the vendor's website. Once someone purchases from the vendor's site, they will pay you a commission. Affiliate programs can help build a reputation and increase your income. As long as you provide quality content and services, it would be best if you eventually attract your audience.