A balance transfer fee is a fee that credit card companies charge when you transfer an outstanding balance from one card to another. Credit card companies are permitted to charge this fee even when they offer a zero percent introductory interest rate on the new card. This fee is subject to change depending on the credit company.

Balance transfer APR 0%

Some credit cards issuers offer 0% promotional APR deals for balance transfers or purchases. These deals are usually offered to new cardholders but some issuers offer them to current cardholders. You should read the terms before applying. Some promotional purchases may have a shorter duration than others.

In certain cases, this 0% promotional purchase APR is enough to cover large purchases or temporary financial hardships like a pay cut or furlough. It is not always the best choice, especially for people with poor credit. You should work out a payment schedule that is feasible and can be paid on time to make the most of this offer. Divide your total owing amount by the number months that the offer is valid to do this. You would have to pay $100 each month if your outstanding $1,200.

Transfer fee: 0%

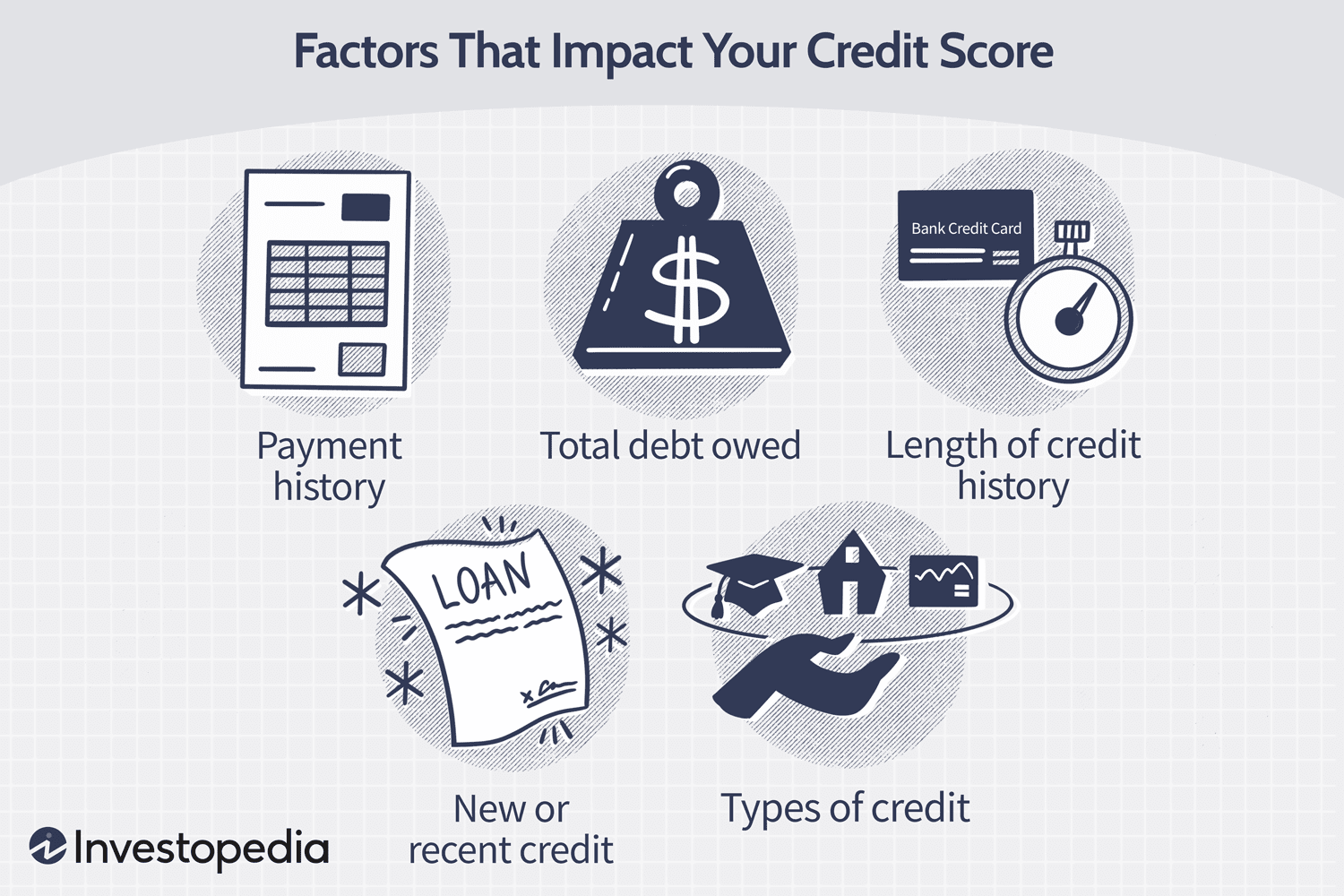

If you want to move your credit card balances without having to pay any fees, then 0% balance transfers fee offers are the best option. Be aware of these things before you transfer balances to new cards. Balance transfer fees can prove to be quite expensive. Some fees can be as high as 3% of the amount transferred. You will also have to pay interest for the balance you transfer after the 0% period has ended. This means that it is important to allow enough time for you to find a new card offering a lower Interest Rate. You may also need to have good credit scores in order for some balance transfer providers to allow you transfer your balance.

In general, zero percent balance transfer fees will not accrue interest during the promotional period. If you transfer a balance into a card with a higher interest rate, however, interest will still accrue. This is not ideal. You should instead pay the balance before the promotional period expires.

Experian

Experian balance transfers fees are not payable to you if your account is still open. You should continue making the minimum monthly payment. This will allow you to avoid missed payments and late fees. Experian's free credit scoring monitoring service is a great way to keep track.

Experian CreditMatch allows you to obtain a free credit score, report and credit report. This tool will allow you to compare various credit cards and balance transfers and help you determine which one is best for you. It also offers free ongoing credit report tracking.

Discover

You can consolidate multiple credit card debts with Discover balance transfers. This option can lower your monthly payments as well as offer you rewards. This can also affect your credit score. To avoid paying a late fee, you must pay off the balance transferred before the promotional period expires. Although balance transfer offers from Discover may be subject to change, the best time for balance transfers is in January and March.

You can pay off your debt quicker by using a balance transfer from Discover. Although you can transfer up to 30% from your credit limit, you may have to pay a balance transfer charge. You may not have enough credit to transfer your balance. This can affect your credit score, so you should know your limit before applying for a card.

Capital One

It's essential to check your eligibility before considering a balance transfers. This is particularly true if you have poor credit and want to transfer your debts from a competitor. Capital One also allows balance transfers from other banks and personal and auto loans. To see if the Capital One website is right for you, click here.

Normally, it takes between two and three weeks for a balance transfer. This may vary depending upon which card you use. To ensure that the transfer goes smoothly, you must continue making minimum monthly payments to your accounts. After the transfer is complete, you can use your line of credit to pay off the balances on your other credit cards.

FAQ

What is personal finance?

Personal finance involves managing your money to meet your goals at work or home. This involves knowing where your money is going, what you can afford, as well as balancing your wants and needs.

These skills will allow you to become financially independent. This means that you won't have to rely on others for your financial needs. You won't have to worry about paying rent, utilities or other bills each month.

You can't only learn how to manage money, it will help you achieve your goals. It will make you happier. Positive financial health can make it easier to feel less stressed, be promoted more quickly, and live a happier life.

Who cares about personal finance anyway? Everyone does! The most searched topic on the Internet is personal finance. Google Trends indicates that search terms for "personal finance” have seen a 1,600% increase in searches between 2004-2014.

People now use smartphones to track their money, compare prices and create wealth. These people read blogs like this one and watch YouTube videos about personal finance. They also listen to podcasts on investing.

Bankrate.com estimates that Americans spend on average 4 hours per day viewing TV, listening to music and playing video games, as well reading books and talking with friends. That leaves only two hours a day to do everything else that matters.

Financial management will allow you to make the most of your financial knowledge.

How much debt is considered excessive?

There is no such thing as too much cash. Spending more than you earn will eventually lead to cash shortages. Savings take time to grow. Spend less if you're running low on cash.

But how much can you afford? There's no right or wrong number, but it is recommended that you live within 10% of your income. You'll never go broke, even after years and years of saving.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. Spend less than $2,000 per monthly if you earn $20,000 a year. You shouldn't spend more that $5,000 per month if your monthly income is $50,000

Paying off your debts quickly is the key. This applies to student loans, credit card bills, and car payments. After these debts are paid, you will have more money to save.

It would be best if you also considered whether or not you want to invest any of your surplus income. If the stock market drops, your money could be lost if you put it towards bonds or stocks. But if you choose to put it into a savings account, you can expect interest to compound over time.

Consider, for example: $100 per week is a savings goal. In five years, this would add up to $500. Over six years, that would amount to $1,000. You'd have almost $3,000 in savings by the end of eight years. When you turn ten, you will have almost $13,000 in savings.

You'll have almost $40,000 sitting in your savings account at the end of fifteen years. That's pretty impressive. But if you had put the same amount into the stock market over the same time period, you would have earned interest. Instead of $40,000 in savings, you would have more than 57,000.

It is important to know how to manage your money effectively. Otherwise, you might wind up with far more money than you planned.

What's the difference between passive income vs active income?

Passive income refers to making money while not working. Active income is earned through hard work and effort.

If you are able to create value for somebody else, then that's called active income. It is when someone buys a product or service you have created. You could sell products online, write an ebook, create a website or advertise your business.

Passive income is great as it allows you more time to do important things while still making money. Most people aren’t keen to work for themselves. People choose to work for passive income, and so they invest their time and effort.

The problem is that passive income doesn't last forever. You might run out of money if you don't generate passive income in the right time.

You also run the risk of burning out if you spend too much time trying to generate passive income. Start now. If you wait to start earning passive income, you might miss out opportunities to maximize the potential of your earnings.

There are three types or passive income streams.

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

Investments - These include stocks, bonds and mutual funds as well ETFs.

-

Real Estate - this includes rental properties, flipping houses, buying land, and investing in commercial real estate

What is the fastest way to make money on a side hustle?

You can't just create a product that solves someone's problem to make quick money if you want to really make it happen.

You need to be able to make yourself an authority in any niche you choose. It means building a name online and offline.

Helping people solve problems is the best way build a reputation. Consider how you can bring value to the community.

Once you've answered the question, you can immediately identify which areas of your expertise. There are many opportunities to make money online. But they can be very competitive.

However, if you look closely you'll see two major side hustles. The first involves selling products or services directly to customers. The second involves consulting services.

Each approach has pros and cons. Selling products or services offers instant gratification, as once your product is shipped or your service is delivered, you will receive payment immediately.

On the flip side, you might not reach the level of success you desire unless you spend time developing relationships with potential clients. In addition, the competition for these kinds of gigs is fierce.

Consulting allows you to grow your business without worrying about shipping products or providing services. However, it can take longer to be recognized as an expert in your area.

In order to succeed at either option, you need to learn how to identify the right clientele. It takes some trial and error. But, in the end, it pays big.

What is the easiest way to make passive income?

There are many online ways to make money. Some of these take more time and effort that you might realize. How can you make extra cash easily?

The answer is to find something you love, whether blogging, writing, designing, selling, marketing, etc. It is possible to make money from your passion.

For example, let's say you enjoy creating blog posts. Start a blog where you share helpful information on topics related to your niche. When readers click on those links, sign them up to your email list or follow you on social networks.

This is affiliate marketing. There are lots of resources that will help you get started. Here are 101 affiliate marketing tips and resources.

Another option is to start a blog. Once again, you'll need to find a topic you enjoy teaching about. However, once you've established your site, you can monetize it by offering courses, ebooks, videos, and more.

Although there are many ways to make money online you can choose the easiest. If you really want to make money online, focus on building websites or blogs that provide useful information.

Once you have created your website, share it on social media such as Facebook and Twitter. This is known content marketing.

How to build a passive income stream?

To consistently earn from one source, you need to understand why people buy what is purchased.

It is important to understand people's needs and wants. Learn how to connect with people to make them feel valued and be able to sell to them.

The next step is how to convert leads and sales. To keep clients happy, you must be proficient in customer service.

Although you might not know it, every product and service has a customer. Knowing who your buyer is will allow you to design your entire company around them.

To become a millionaire takes hard work. It takes even more to become billionaire. Why? Because to become a millionaire, you first have to become a thousandaire.

Then you must become a millionaire. Finally, you can become a multi-billionaire. The same is true for becoming billionaire.

How does one become billionaire? It all starts with becoming a millionaire. All you have do is earn money to get there.

Before you can start making money, however, you must get started. Let's discuss how to get started.

Statistics

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

External Links

How To

How to make money when you're sleeping

If you are going to succeed online, you must learn how to sleep while you are awake. You must learn to do more than just wait for people to click on your link and buy your product. Make money while you're sleeping.

This requires that you create an automated system which makes money automatically without having to do anything. You must learn the art of automation to do this.

It would be a great help to become an expert in building software systems that automate tasks. You can then focus on making money, even while you're sleeping. Automating your job can be a great option.

You can find these opportunities by creating a list of daily problems. Next, ask yourself if there are any ways you could automate them.

Once you've done this, it's likely that you'll realize there are many passive income streams. Now you need to choose which is most profitable.

You could, for example, create a website builder that automates creating websites if you are webmaster. Or if you are a graphic designer, perhaps you could create templates that can be used to automate the production of logos.

A software program could be created if you are an entrepreneur to allow you to manage multiple customers simultaneously. There are hundreds to choose from.

Automating anything is possible as long as your creativity can solve a problem. Automation is key to financial freedom.